Financial Aid

Financial Aid

Quick Links

Embarking on the journey of higher education is an exciting yet significant decision for students and their families. At our college, we understand that financial considerations can sometimes be a concern, and that’s where our dedicated Financial Aid Department comes in to support you.

We offer a range of assistance programs, including scholarships, grants, loans, work-study opportunities, and veteran benefits designed to help ease the financial burden associated with tuition, textbooks, housing, and other essential expenses. By providing these resources, we aim to empower you to focus on your academic pursuits without the stress of financial constraints.

At our college, we recognize that investing in your education is an investment in your future. Our Financial Aid Department is here to guide you through the process, ensuring that you have the support you need to make the most of your college experience. Join us on this transformative journey, where your potential is our priority, and together, we’ll shape a future full of opportunities.

To learn more about financial aid, please make an appointment with one of our Financial Aid Officers.

Learn more about the application process.

It is easy to feel overwhelmed when navigating the financial aid process. Here you will find your Financial Aid Checklist of steps that need to be completed so we can determine your financial aid eligibility. If you have questions or need any assistance with the financial aid process, please feel free to make an appointment with the Financial Aid Office

- Create your FSA ID at https://studentaid.gov/. Click “Create an Account” and the site will walk you through how to create the FSA ID or how to retrieve yours if you have ever completed the FAFSA application in the past.

- If you know your FSA ID information, you can access the FAFSA directly at https://studentaid.gov/h/apply-for-aid/fafsa

- Complete the FAFSA. Please complete the 2025-2026 AND 2026-2027 FAFSA applications. Our federal school code is 032503.

- January 2026 Cohort– Complete the 2025-2026 FAFSA and 2026-2027 FAFSA (becomes available on 10/1/2024).

- April 2026 Cohort– Complete the 2025-2026 FAFSA and 2026-2027 FAFSA (becomes available on 10/1/2024).

- July 2026 Cohort– Complete the 2026-2027 FAFSA.

- Complete Loan Entrance Counseling here: https://studentaid.gov/entrance-counseling/. We are listed as community based education and development.

- Complete Master Promissory Note here: https://studentaid.gov/mpn/. We are listed as community based education and development.

- Notify the Financial Aid Office when you have completed all above steps.

U.S. citizens and eligible non-citizens who wish to be considered for financial aid are required to complete the Free Application for Federal Student Aid (FAFSA). The FAFSA is used to determine a student’s eligibility for federal and state financial aid. Complete the FAFSA every academic year, as early as possible. The FAFSA becomes available each year on October 1st. CBD College’s Federal School Code is 032503.

Eligibility

To receive federal financial aid a student must meet all of the following requirements:

- Demonstrate financial need

- Have a high school diploma or General Education Development (GED) certificate or state-recognized equivalent

- Be enrolled as a regular student in an eligible program

- Be a U. S. citizen or eligible noncitizen

- Have a valid Social Security Number

- Maintain satisfactory academic progress

- Not be in default on a financial aid loan nor owe a refund to a financial aid grant received at any college or institution

- Provide required documentation for the verification process and determination of dependency status

- Not have borrowed in excess of the annual aggregate loan limits for the Title IV financial aid programs

- Not have exceeded the Lifetime Eligibility Limit (LEU) for Federal Pell Grant

Students must complete the FAFSA each year at which point their continued eligibility will be evaluated and determined by the CBD College Financial Aid Office.

Need assistance? Please schedule a General Financial Aid Appointment with the Financial Aid Office.

FAFSA Helpful Videos

Eligibility

The California Dream Act Application (CADAA) allows undocumented and DREAMER students to apply for California state financial aid to attend eligible California colleges and universities. Students who live in California and meet the eligibility requirements for non-resident exemption, as well as students who have a U Visa or TPS status, are eligible to complete the Dream Act Application. Please note that applicants must qualify for an AB 540 nonresident tuition exemption in order to qualify.

Apply

The California DREAM Act Application can be completed on the California Student Aid Commission Website. The application becomes available each year on October 1st, and the priority deadline for submitting is March 2nd.

Additional questions? Visit the California DREAM Act Resources webpage.

Explore this section to learn about how financial aid works.

Your Cost of Attendance, or Financial Aid Budget, is the estimated average and reasonable cost of pursuing a degree at CBD College. The Cost of Attendance serves as a component of the calculation used to determine your financial need as well as the total amount of aid that can be offered to you in an academic year.

Your Cost of Attendance includes the estimated cost of the living expenses below on a weekly basis (costs not charged by CBD College) over the course of your program of study plus the cost of tuition, books and fees (costs that are charged by CBD College) for our program which can be found in CBD College’s Catalog.

Verification is a process required by the Department of Education and the California Student Aid Commission that is intended to improve the accuracy of the information provided on the FAFSA. We cannot disburse federal or state aid until the verification process is complete.

If you have been selected for verification, The Financial Aid Office will notify you by email and send you any forms that need to be completed via Doc-u-sign. If you are a dependent student, you may receive forms that require parental information and a parent signature. Once all forms and requested documents have been received by the Financial Aid Office, the verification of your FAFSA will be reviewed in 7-14 business days. Once verification is complete, the student’s eligibility for financial aid will be determined and the student will receive their financial aid award letter.

If you need assistance with the Verification process, please feel free to schedule an appointment. We are happy to assist you.

Satisfactory Academic Progress Policy

All students are required to maintain satisfactory academic progress (SAP) to remain eligible for financial aid. Satisfactory academic progress is evaluated at the end of each payment period for non-term programs with a start date prior to July 1, 2023. For term programs with a start date after July 1, 2023, SAP is evaluated at the completion of each module (which aligns with the payment period) once all grades are finalized.

Qualitative Measure

A student must maintain a 2.0 GPA cumulatively as well as a 2.0 in current classes if the end of the payment period is before grades are finalized for the module. A student must pass all modules or courses with a minimum grade of 75% based on a scale of 0-100%.

Quantitative Measure

A student must complete at least 67% of all quarter credit hours attempted on a cumulative basis during each evaluation period. Evaluation periods are equal to one payment period.

Maximum Time Frame

A student must complete the entire program within 1.5 times the normal completion rate, or within:

Maximum 135 attempted quarter credit hours for the 90 quarter credit hours BSHS program

Maximum 135 attempted quarter credit hours for the 90 quarter credit hours MRI AAS program

Maximum 136.5 attempted quarter credit hours for the 91 quarter credit hours ST AAS program

Maximum 152.25 attempted quarter credit hours for the 101.5 quarter credit hours PTA AAS program

Maximum 169.5 attempted quarter credit hours for the 113 quarter credit hours OTA AAS program

Maximum 180 attempted quarter credit hours for the 120 quarter credit hours DMS AAS program

Satisfactory academic progress requirements apply to every student whether or not the student is receiving financial aid. For more detailed information, please see CBD College’s full SAP Policy.

Satisfactory Academic Progress Appeal

If you are ineligible for financial aid because you are not meeting SAP requirements due to extenuating circumstances that hindered your academic performance, you may submit a SAP Appeal within five (5) days in order that your eligibility be reconsidered. Please note that submission of a SAP appeal does not guarantee it’s approval, and you should not assume financial aid eligibility until your appeal is approved.

In order for a SAP Appeal to be considered, the student must provide the Registrar with a letter that includes:

- Information about the circumstances or events that prevented the student from attaining SAP

- What has changed in the student’s situation that will allow the student to demonstrate satisfactory academic progress at the next evaluation.

The Records Officer will review only the appeals that have the necessary documentation and are based on:

- Severe illness, medical condition, or injury

- Death of an immediate family member

- Military deployment/call to active duty

- Or other special circumstances which are unlikely to occur

Please email your Appeal Letter including the above content AND documentation of circumstances to CBD College’s Registrar, Inna Baboyan, at inna@cbd.edu.

The method by which students receive any financial aid refund that may be due to them depends on if they are enrolled in a term or non-term program. Generally, if the student became enrolled in their program prior to 7/3/2023 then they are enrolled in a non-term program. If a student became enrolled in their program on 7/3/2023 or after then they are enrolled in a term program.

Non-Term Refund Process

There are two disbursements per academic year for non-term programs. The first financial aid disbursements are made on or after 30 days of school attendance once the student becomes a regular student according to the college’s Conditional Enrollment Policy. The second disbursements are made on or after the midpoint of the program of study for non-term programs.

The student’s financial aid will be applied to the student’s account for tuition and fees. Any remaining funds will be paid to the student or to parents, if parents qualify for a Direct PLUS loan. If the student or student’s parent is due a refund it will be sent via an emailed link to a Deluxe eCheck. The student or parent will need to print out the Deluxe e-Check in order to cash it.

Term Refund Process

There are up to four disbursements per academic year for term programs. The student’s financial aid will be requested within 3 weeks of the start of a student’s term. For new students, funds are not requested unless the student is admitted as a regular student in accordance with the college’s Conditional Enrollment Policy. Once a student is admitted as a regular student, funding will be requested within 3 weeks. The student must be making SAP as of the last term(module) completed.

The student’s financial aid will be applied to the student’s account for tuition and fees. Any remaining funds will be paid to the student or to parents by check, if parents qualify or for a Direct PLUS loan. If the student or student’s parent is due a refund it will be sent via an emailed link to a Deluxe eCheck. The student or parent will need to print out the Deluxe e-Check in order to cash it.

For any questions regarding payments or refunds, please contact CBD College’s Student Accounts Office by email at sa@cbd.edu

At CBD College, we understand that special or unusual circumstances may arise that can affect your financial aid eligibility. If you believe you have special or unusual circumstances that warrant consideration from our office, please review our Professional Judgement Policy for more information.

Special Circumstances

Your financial aid eligibility is based on a standard Cost of Attendance, or Financial Aid Budget, which serves as the foundation for your financial need calculation and limit for how much financial aid you can receive. We may be able to increase your budget and financial aid eligibility if you incur expenses within the academic year that are higher than the standard financial aid budget. Adjustments typically result in an increase in loan or Work Study eligibility. Documentation of incurred expenses is required in order for your appeal to be reviewed.

Below are examples of situations that warrant a request for Special Circumstances. This is not an extensive list. Please email fa@cbd.edu to request an appointment with the Director of Financial Aid or Assistant Director of Financial Aid to discuss your individual situation.

- Unusually high medical/dental expenses

- Death or disability of a family wage earner

- One Time taxable income

- Change of marital status

- Loss of employment

- Child support reduction change

- Changes in family’s reported income

To request a Professional Judgement for Special Circumstance, please email fa@cbd.edu to request the secure DocuSign form. Please submit the form with all supporting documentation. For an example of the form please view the 25-26 Special Circumstances form.

Unusual Circumstances

Students may have unusual circumstances that prevent them from providing parent and/or legal guardian information on the FAFSA. Below are examples of situations that warrant a request for Unusual Circumstance. This is not an extensive list. Please email fa@cbd.edu to request an appointment with the Director of Financial Aid or Assistant Director of Financial Aid to discuss your individual situation. Please note that a parent’s refusal to provide their information on the FAFSA does not qualify the student for an unusual circumstance.

- The student was voluntarily or involuntarily removed from their parents’ home due to a situation that threatened the student’s health and/or safety

- Parents are currently suffering from mental or physical illness and cannot be contacted

- Student is a victim of human trafficking

- Student is a refugee or asylee

To request a Professional Judgement for Unusual Circumstance, please email fa@cbd.edu to request the secure DocuSign form. Please submit the form with all supporting documentation. For an example of the form please view the 25-26 Unusual Circumstances form.

Cancellation/Refund Policy

Students have the right to cancel their enrollment in a program, without any penalty or obligations, through attendance at the first session or the seventh (7) calendar day after enrollment, whichever is later. After the end of the cancellation period, students also have the right to stop school at any time; and have the right to receive a pro-rata refund if students have completed 60% or less of the scheduled credit in the current payment period in their program through the last day of attendance. For more details please refer to the Institutional Refund and Return of Title IV Funds Policy in CBD College’s Catalog.

The requirements and procedures for officially withdrawing from the school are outlined in CBD College’s Cancelation/Refund Policy.

Learn more about the types of aid available.

Federal Pell Grant

The Federal Pell Grant is awarded to undergraduate students who have not earned a bachelor’s or a professional degree. There is a lifetime limit of 600% eligibility (12 semesters at full-time enrollment) for these grants.

The grant amount is determined based on financial need and is calculated based on a student’s SAI (Student Aid Index) as determined by the FAFSA. Your eligibility is automatically determined when CBD College receives your FAFSA and will be reflected in your financial aid award letter.

For more detailed information, please read the most current Federal Pell Grant information from the Department of Education, including award amounts. Annual award amounts are prorated if you enroll in less than 12 credit hours per term.

Federal Supplemental Educational Opportunity Grant

The Federal Supplemental Education Opportunity Grants (FSEOG) is a federally funded grant awarded to students with exceptional need as determined by the FAFSA. Your eligibility is automatically determined when CBD College receives your FAFSA and will be reflected in your financial aid offer letter. FSEOG is awarded to eligible students in the amount of $100.00 per term.

Federal Work Study

The Work Study Program is a financial aid program that promotes part-time employment for students to help finance their education. Work Study is awarded based on financial need as determined by the FAFSA. Work study is not awarded automatically and students must apply for this type of financial aid via a Work Study Application after having submitted the FAFSA.

As part of your financial aid package, Work Study jobs provide an opportunity to earn part of your college costs rather than increase your loans. When you take advantage of Work Study opportunities, you will:

- Gain valuable job skills and experience

- Build your resume

- Expand your social and professional network

- Work Study income will be paid directly to you

Please contact the Financial Aid Office (fa@cbd.edu) if you would like to complete a Work Study Application.

Cal Grants

The Cal Grant is a form of California state financial aid awarded to eligible students that does not need to be repaid. To apply for the Cal Grant the student must complete the FAFSA or CA DREAM Act Application by the deadline set forth by the California Student Aid Commission. The student must also meet all eligibility, financial and minimum GPA requirements of either program.

There are three types of Cal Grants – A, B and C. However, students do not have to apply for them individually. Each student’s individual eligibility will be based on the FAFSA or CA DREAM Act Application, verified Cal Grant GPA, the type of California college listed on your application and whether the student is a recent high school graduate.

In order to be eligible a student must:

- Submit the FAFSA or CA Dream Act Application and your verified Cal Grant GPA by the deadline of MARCH 2ND.

- Be a U.S. citizen or eligible noncitizen or meet AB540 eligibility criteria

- Be a California resident for 1 year

- Attend a qualifying California college

- Not have a bachelor’s or professional degree

- Have financial need at the college of your choice

- Have family income and assets below the minimum levels

- Be enrolled or plan to enroll in a program leading to an undergraduate degree or certificate

- Be enrolled or plan to enroll at least half time

- Not owe a refund on any state or federal grant or be in default on a student loan

- Not be incarcerated

- Maintain the Satisfactory Academic Progress standards as established by the school. Recipients who do Not meet the standards are ineligible for Cal Grant payment and will not use eligibility during the terms they are ineligible for payment.

Reviewing the Cal Grant Frequently Asked Questions can answer most questions students may have. Explore additional resources below.

Cal Grant Program Comparison Chart

Cal Grant Disqualification Fact Sheet

CA Dream Act

The California Dream Act Application (CADAA) allows undocumented and DREAMER students to apply for state financial aid to attend eligible California colleges and universities. Students who live in California and meet the eligibility requirements for non-resident exemption, as well as students who have a U Visa or TPS status, are eligible to complete the Dream Act Application for state financial aid. Please note that applicants must qualify for an AB 540 nonresident tuition exemption in order to be eligible.

The California DREAM Act Application can be completed on the California Student Aid Commission Website. The application becomes available each year on October 1st, and the priority deadline for submitting is March 2nd.

Additional questions? Visit the California DREAM Act Resources webpage.

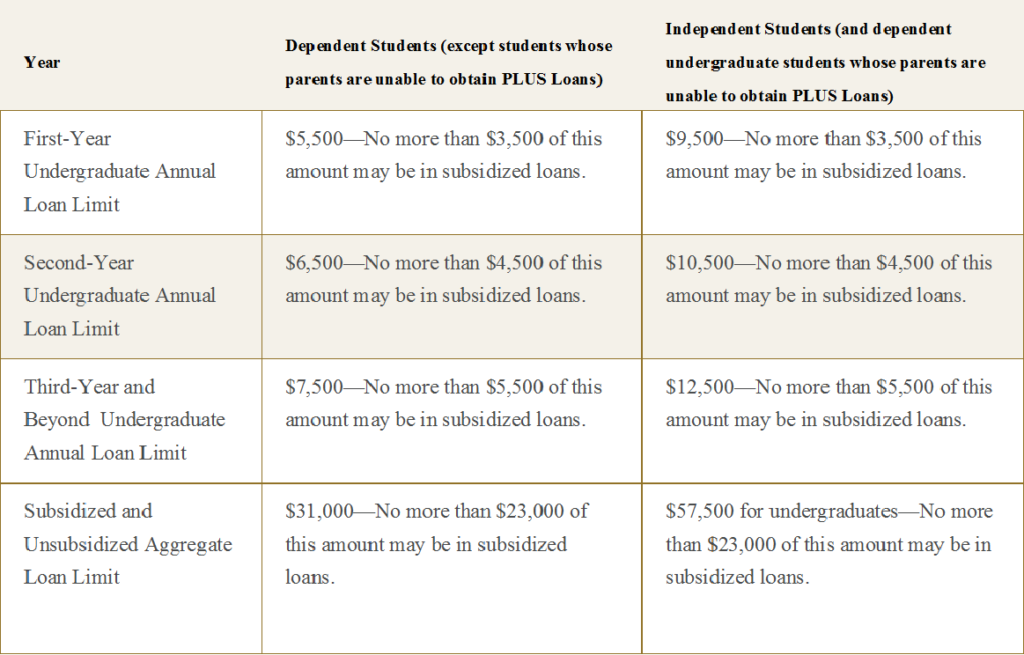

Direct Loans

Direct Subsidized Loans – awarded to undergraduate students who have financial need; U.S. Department of Education generally pays interest while student is in school and during certain other periods. Please visit studentaid.ed.gov located here for the latest information on interest rates. Borrowers may not receive this type of loan for more than 150 percent of the length of their program of study; the U.S. Department of Education may stop paying interest if the student who received Direct Subsidized Loans for the maximum period continues enrollment.

Direct Unsubsidized Loans – Financial need is not required; borrower is fully responsible for paying the interest regardless of the loan status. The Interest on unsubsidized loans accrues from the date of disbursement and continues throughout the life of the loan. Please visit studentaid.ed.gov located here for the latest information on interest rates.

Not sure if you are a dependent or independent student? Click here for more information.

Student Loan Entrance Counseling – Prior to first disbursement of federal loans, all borrowers of a Federal Direct Loan will be required to complete Entrance Counseling, which will provide comprehensive information on the terms and conditions of the loans and of the borrower’s responsibilities.

All students will be required to complete Exit Counseling before they graduate or withdraw. Exit Counseling will help students calculate their anticipated monthly repayment amount, choose repayment plan options, and will provide other important information.

Students can sign into https://www.studentaid.gov to see what Federal student loans they have and who was assigned as the student’s loan servicer.

Students who will borrow Direct Loans will be required to repay the loans plus the interest regardless of the loan status. If a student withdraws, a refund calculation will be completed and funds will be returned to federal programs in the order required by the U.S. Department of Education. The interest rates for federal student loans are determined by federal law.

The interest rate varies depending on the loan type and (for most types of federal student loans) the first disbursement date of the loan. To calculate a sample loan repayment schedule, please use Federal Student Aid’s Student Loan Estimator Tool.

Direct PLUS Loans

A dependent student’s parent may apply for a Direct PLUS Loan, also referred to as a Parent PLUS Loan, to pay for their child’s educational expenses. To receive a Parent PLUS loan, you must

- be the biological or adoptive parent (or in some cases, the stepparent) of a dependent undergraduate student enrolled at least half-time at an eligible school;

- not have an adverse credit history (unless you meet certain additional requirements); and

- meet the general eligibility requirements for federal student aid

For Direct PLUS Loans first disbursed on or after July 1, 2024, and before July 1, 2025, the interest rate is 9.08%. This is a fixed interest rate for the life of the loan.

The student must complete the FAFSA and the parent must complete the Direct PLUS Loan application in order to apply. Please email the CBD Financial Aid Office at fa@cbd.edu to express your interest in applying for a Direct PLUS Loan.

Not sure if you need the full amount of loans you have been offered? Use this calculator to help you determine how much you need to borrow.

Private Educational Loans

Students have the option to apply for a private education loan in place of, or in addition to federal and state aid. Students are strongly encouraged to pursue the availability of free or lower-cost financial aid with the school’s financial aid office before pursuing a private student loan. The terms and conditions of federal student loans are more favorable than the provisions of private education loans. For more information, see Federal Student Aid’s comparison of Federal versus Private Loans.

CBD College will certify any private education loan that extends credit to students. We do not have a preferred lender list. Students are encouraged to conduct research and review each lender’s terms and conditions before applying for a private student loan with a lender. It is important to review and compare the terms, interest rates, associated fees and repayment options before accepting the private student loan.

Once you have selected and applied for a loan with a lender of your choice, please send the approval letter to your Financial Aid Officer. Some lenders will send loan funds to the school and others may send the funds directly to you in order that you may pay your tuition balance.

CBD College is approved by the California State Approving Agency for Veterans Education (CSAAVE) to accept veteran’s benefits to train Veterans & eligible persons. In order to utilize your benefits to pay for your education, you must first complete the Application for Veterans Educational Benefits on the GI Bill® Website to determine which of the following benefits you qualify for.

- Chapter 30 – Montgomery GI Bill®: Contributed $1200 while on Active Duty and generally benefits are payable for 10 years following your release from active duty.

- Chapter 31 – Vocational Rehabilitation and Employment Program (Voc Rehab): Helps veterans with service-connected disabilities prepare for, find, and keep suitable jobs through educational opportunities.

- Chapter 33 – Post 9/11 GI Bill®: Served on active duty for at least 90 aggregate days on or after 09/11/2001 and must waive all other educational benefits.

- Chapter 35 – Dependent’s Educational Assistance (DEA): Provides education and training opportunities to eligible dependents of certain veterans.

- Chapter 1606 – Montgomery GI Bill® Selected Reserves (MGIB-SR): The program may be available if you are a member of the Selected Reserves.

- Chapter 1607 – Reserve Educational Assistance Programs (REAP): Designed to provide educational assistance to members of the Reserve components called to active duty in response to a war or national emergency.

- Tuition Assistance – TA Educational Assistance Program: Tuition Assistance may be provided to eligible active duty and Reserve members through their respective military.

The VA will send you your Certificate of Eligibility within 30 days of completing the application. This certificate will summarize what benefits you are eligible to use to pay for your education. Please email your Certificate of Eligibility along with your DD-214 to our Veterans Certifying Official, Jessica Turner.

Callie Driskill

Veterans Certifying Official

cdriskill@cbd.edu

38 USC Sec. 3679E Compliance Policy

Federal law requires disapproval of courses of education at any educational institution that does not have a policy in place which will allow an individual to attend or participate in a course of education, pending US Department of Veteran Affairs (VA) benefits payment, providing the individual submits a VA Certificate of Eligibility (CEO) for entitlement to educational assistance under Chapter 31 (Post 9/11-G.I. Bill®) or Chapter 33 (Vocational Rehabilitation and Employment) and Chapter 35 (Survivors’ and Dependents’ Educational Assistance Program).

In accordance with applicable law, CBD College adopts the following provision for any students using Chapter 31, Chapter 33 or Chapter 35 benefits, while payment to the institution is pending from VA. CBD College will not:

- Prevent the student’s enrollment;

- Assess the student a late penalty fee;

- Require the student to secure alternative or additional funding;

- Deny the student access to any resources (e.g., access to classes, library, or other institutional facilities) available to other students, who have satisfied their tuition and fee bills to the institution.

To qualify for this provision, eligible students may be required to:

- Produce the VA COE by the first day of class;

- Submit a written request to use this entitlement;

- Provide additional information needed to properly certify the enrollment.

GI Bill® is a registered trademark of the U.S. Department of Veterans Affairs (VA). More information about education benefits offered by VA is available at the official U.S. government Web site at https://www.benefits.va.gov/gibill.

A scholarship is financial support awarded to a student based on specific criteria such as academic achievement, career interest, community involvement or financial need, just to name a few. Funds awarded to students via a scholarship do not need to be repaid.

Institutional Scholarships

Exam Fee Scholarship: CBD College award eligible students an exam fee scholarship to cover the cost of their credentialing exam in their final year of the program. If interested, please email the Financial Aid Office ad fa@cbd.edu for the application.

CBD College Presidential Scholarship: This institutional scholarship is awarded to 5 eligible students per cohort in the Occupational Therapy Assistant and Physical Therapy Assistant programs based on financial need as determined by students’ FAFSAs. There is no separate application process to qualify. The amount of the scholarship is up to $1,000 for each module in modules 2-7 for a total of up to $6,000. This is a last dollar scholarship and will only cover any outstanding balance due after all other forms of financial aid have been applied.

Outside Scholarships

The websites below contain scholarship databases that may help you with your search to find scholarships you are eligible to apply for.

Scholly® Scholarships by SallieSM

Financial Resources

Understanding the details of repayment on your federal student loans can save you time and money. Before repayment begins, develop a plan that puts you on track to pay back your loan on time and in full.

Beginning Repayment

Once you graduate, drop below half-time enrollment, or leave school, your federal student loan goes into repayment. However, if you have a Direct Subsidized or Direct Unsubsidized Loan you have a six-month grace period before you are required to start making regular payments.

Repayment Plans

When your loan enters repayment, your loan servicer will automatically place you on the Standard Repayment Plan. You can request a different repayment plan at any time. Not sure who your student loan servicer is? Check here! To discuss repayment plan options or change your repayment plan, contact your loan servicer.

Types of Repayment Plans

You can also utilize Federal Student Aid’s Loan Simulator Tool to get an early picture of which plans you may be eligible for and to see estimates for how much you would pay monthly and overall.

Student Loan Forgiveness

In certain situations, you can have your federal student loans forgiven, canceled, or discharged. Learn more about the types of forgiveness and whether you qualify due to your career path or other circumstances here.

Scholarships

Scholarships not only alleviate the financial burden of education but also serve as a testament to YOUR dedication, passion, and potential. No matter where you are in your educational journey, this information is designed to equip you with the knowledge and skills needed to pursue and secure scholarships with confidence.

Presentation: Scholarships: Finding FREE Money For College

Videos

Types of Grants and Scholarships

Student Story: Searching for Scholarships

Student Story: Applying for Scholarships

Student Story: Relying on Scholarships

Readings:

Federal Student Aid – Scholarships

10 Ways to Stand Out When Applying for Scholarships

How to Write a Winning Scholarship Essay

Helpful Tools:

Scholarship Application Tracker

Scholarship Preparation Worksheet

Budgeting 101

Budgeting is a crucial financial management tool that helps individuals, and families plan and control their spending and income. Money can be tight while in college so it is even more important at this time to have a plan when it comes to your finances. The primary goal of budgeting is to ensure financial stability and achieve your financial goals.

Presentation: Budgeting 101

Videos:

“How to Set a Budget and stick to it”

“Tips and Techniques for Managing Your Money”

“How to Save Money on Everyday Expenses”

Readings:

“The Student’s Guide to Budgeting in College”

Federal Student Aid: “Budgeting”

“Good Ways to Save Money in College”

Tools/Resources:

Banking Basics

Understanding banking is not merely a matter of managing accounts or making transactions; it is the key to unlocking a world of financial opportunities, responsible decision-making, and long-term economic well-being. This section will equip you with the essential knowledge and skills needed to navigate the landscape of banking, empowering you to make informed choices and secure your financial future.

Presentation: Banking Basics

Videos:

Readings:

Choosing a Student Bank Account

What to Know About Banks and Checking Accounts for College Students

Credit versus Debit: What’s the Difference?

Tips when using Mobile Devices for Financial Services

Tools/Resources:

Comparing Checking Accounts Worksheet

Simple & Compound Interest Calculator

Understanding Credit

Understanding credit is a fundamental aspect of financial literacy that plays a pivotal role in students’ lives. Credit is essentially a financial tool that allows people to borrow money or access goods and services with the commitment to repay the borrowed amount over time. A credit score is a key factor in determining the terms of loans, interest rates, and even eligibility for certain jobs or housing. By comprehending how credit works, students can make informed decisions about managing their financial responsibilities.

Presentation: Understanding Credit

Videos:

How to Use Credit Cards Wisely

How to Build Credit & Improve Your Credit Score

Readings:

Credit: What it is and How it Works

Guide to Credit & Credit Cards for Students

How to Pay Off Credit Card Debt

Tools/Resources:

Request your Free Annual Credit Report

Student Loan Repayment

Student Loans

Navigating the landscape of higher education often involves grappling with the financial realities of pursuing a degree. Student loans appear as a critical component, offering options for many students to access the education they aspire to but may not be able to afford upfront. While student loans can be instrumental in bridging the financial gap, understanding the intricacies of student loans is essential. Financial literacy regarding student loans empowers students to make informed decisions, manage debt responsibly, and pave the way for a more secure financial future.

Presentation: Student Loans

Readings:

Federal Student Aid: Undergraduate Loans

Federal Student Aid: Student Loan Repayment

Federal Student Loans Explained

Videos:

How to Manage Your Student Loans

Student Loan Repayment Options

Tools/Resources:

Federal Student Aid Loan Simulator

Identity Theft

In an era dominated by digital interactions and online connectivity, the importance of identity theft education has never been more crucial. Identity theft, a pervasive and evolving form of cybercrime, poses significant risks to individuals, businesses, and society as a whole. As technology continues to advance, so do the methods employed by identity thieves, making it imperative for students to be well-informed and proactive in safeguarding their personal information. Identity theft education serves as a vital tool in empowering students with the knowledge and skills necessary to protect themselves against the growing threat of identity theft, fostering a safer and more secure digital landscape for everyone.

Presentation: Identity Theft

Readings:

5 Ways to Protect Yourself from Identity Theft in College

How to Spot and Avoid Scholarship Scams

Videos:

Why Care About Identity Theft?

IdentityTheft.gov Helps You Report & Recover from Identity Theft

Play it Safe: Protect Yourself from Student Loan Scams

Your Source for a Truly Free Credit Report? AnnualCreditReport.com

Below you will find a list of cost estimates for each program for students enrolling in the 2024-2025 academic year. These cost estimates are based on full federal financial aid eligibility. Please note that these are estimates and every student’s financial aid eligibility is different. The purpose of these cost estimates is to give the student a general idea of how much of their program could be covered by financial aid under ideal circumstances.